When it comes to protecting your most valuable assets, few things are as essential as insurance. Whether it’s your beloved vehicle or the place you call home, having the right coverage in place can provide peace of mind and financial security. In this comprehensive guide, we dig deep into the world of car insurance, exploring the ins and outs of this vital protection. From understanding the different types of policies to navigating the often confusing jargon, we’ve got you covered. So buckle up and let’s dive into the ultimate guide to car insurance.

As a responsible driver, you may already have homeowners insurance or have considered purchasing it in the future. But how does car insurance fit into the picture? Car insurance, also known as auto insurance, is designed to protect you and your vehicle in the event of an accident, theft, or damage. While homeowners insurance primarily covers your property and its contents, car insurance is specifically tailored to safeguard your car and provide liability coverage for any potential harm caused on the road. By understanding the complexities of car insurance, you can ensure you have the right level of protection for your needs.

Understanding Homeowners Insurance

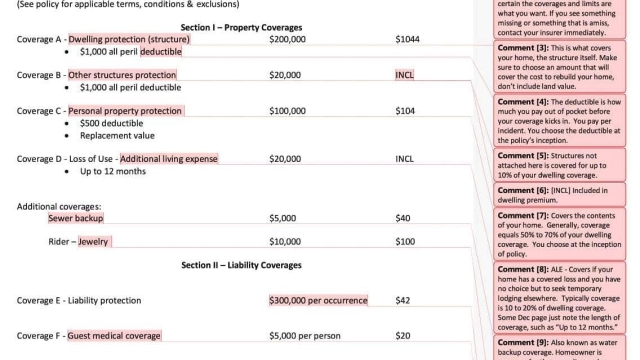

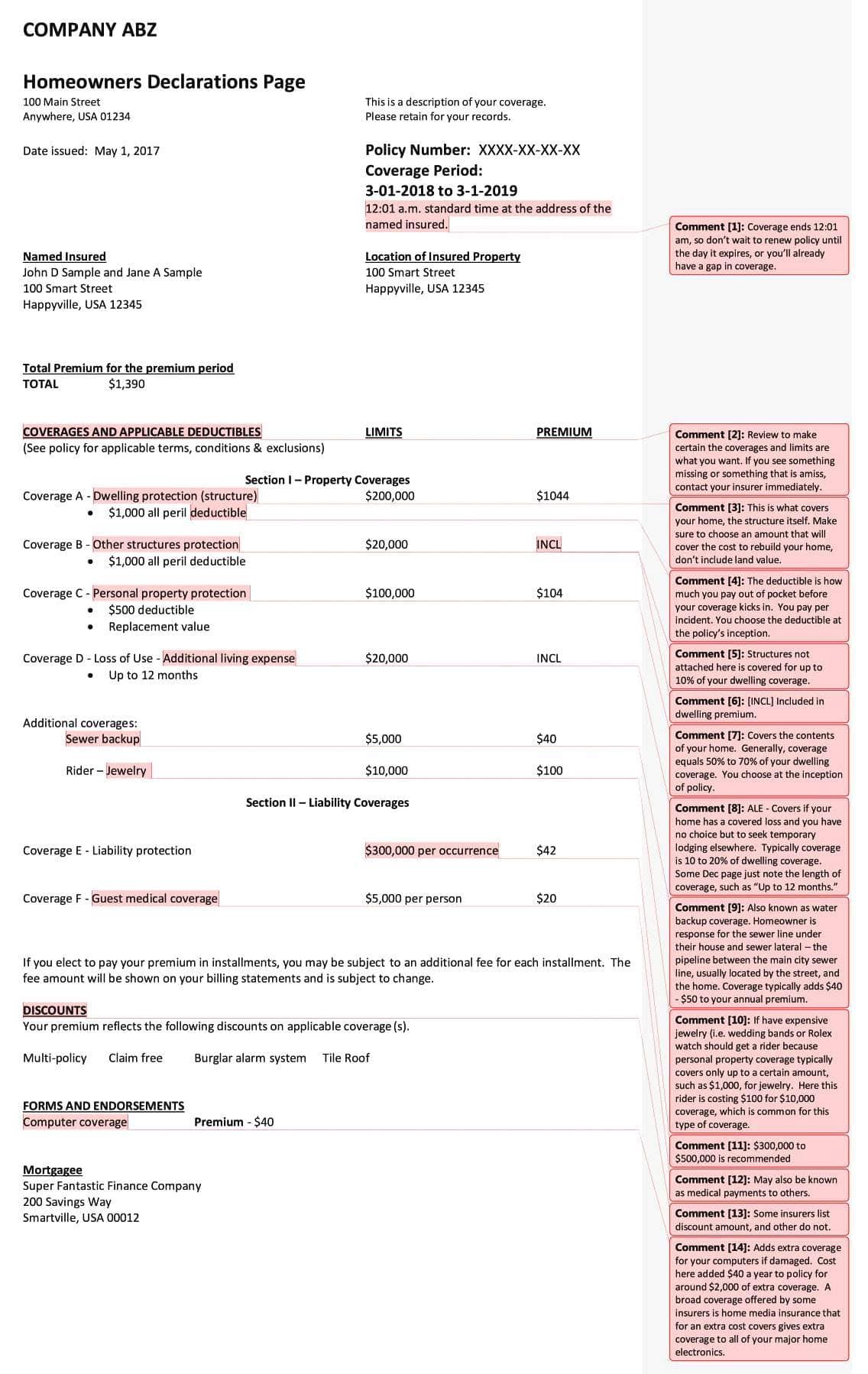

Homeowners insurance is a vital protection for any homeowner. It offers coverage for your home and its belongings in the event of unforeseen circumstances. This type of insurance safeguards you financially against hazards like natural disasters, fires, theft, and liability issues.

In most cases, homeowners insurance consists of two main components: property coverage and liability coverage. Property coverage helps protect your home’s structure and your personal possessions, while liability coverage provides financial support if someone gets injured on your property and sues you for damages.

When determining the cost of your homeowners insurance, several factors come into play. These include the location and condition of your home, the value of your belongings, and the level of coverage you need. It’s important to accurately assess the value of your property and possessions so that you have adequate coverage in case of an unfortunate incident.

Remember, homeowners insurance is different from car insurance or auto insurance, which provides coverage specifically for vehicles. While car insurance is required by law to protect yourself and others on the road, homeowners insurance is not legally mandated. However, having homeowners insurance is wise, as it can save you from significant financial burdens in the event of unexpected damage or loss.

In the next sections, we will dive deeper into the world of car insurance and auto insurance. Stay tuned to learn more about how to protect your vehicle and yourself on the roads.

Decoding Car Insurance Policies

Understanding the intricacies of car insurance policies can be a daunting task for many. With so many terms and conditions, it can often feel like deciphering a complex code. However, having a clear understanding of your car insurance policy is essential to ensure that you have the coverage you need. In this section, we will demystify some of the key aspects of car insurance and help you decode the policy jargon.

- Homeowners Insurance

While this guide primarily focuses on car insurance, it’s important to note that some insurance companies offer bundled policies that include both homeowners insurance and car insurance. Bundling these policies together can often lead to cost savings and added convenience, as you deal with a single insurer for multiple types of coverage. However, it’s crucial to carefully review the terms and coverage limits of bundled policies to ensure they meet your specific needs.

- Car Insurance Basics

Auto Insurance Grand Rapids Mi

Car insurance, also known as auto insurance, is a contract between you and your insurance provider that protects you from financial loss in the event of an accident, theft, or damage to your vehicle. The policy typically covers both property damage and liability, providing compensation for repairs or replacements, as well as medical expenses and legal costs.

- Understanding Coverage Options

When it comes to car insurance, there are various coverage options available that can be tailored to your needs. These options include liability coverage, which is usually required by law and covers injuries and damages you cause to others. Additionally, collision coverage protects against damage to your vehicle caused by collisions, while comprehensive coverage offers protection against non-collision events such as theft, vandalism, and natural disasters.

By unraveling the complexities of car insurance policies, you’ll be better equipped to navigate the coverage options available to you and ensure that you have the right protection in place. Remember to carefully review your policy, ask questions, and consult with your insurance provider to fully understand the terms and conditions of your car insurance policy.

Choosing the Right Auto Insurance Coverage

When it comes to protecting your car, having the right auto insurance coverage is crucial. With so many options available, it’s essential to choose wisely. Here are some factors to consider when selecting your car insurance coverage.

Firstly, evaluate your needs and requirements. Consider factors such as the age of your car, its value, and how often you use it. If you have a new, high-value vehicle, you may want to opt for comprehensive coverage that provides protection against theft, vandalism, and accidents. On the other hand, if you own an older car with a lower value, you might choose to go for basic coverage that fulfills the legal requirements.

Next, think about your budget. Car insurance premiums can vary significantly depending on the coverage you choose. Evaluate how much you are willing to spend and strike a balance between affordability and the level of protection you desire.

Additionally, take into account your driving habits and location. Owning a home can have an impact as well since bundling your car insurance with homeowners insurance might offer additional benefits. If you live in an area with a higher risk of accidents or theft, you may want to consider coverage that includes added protection for these situations.

In conclusion, choosing the right auto insurance coverage requires careful consideration. By evaluating your needs, budget, and circumstances, you can make an informed decision that provides the protection you need while staying within your means. Remember to regularly review your coverage to ensure it remains suitable as your circumstances change.